It’s been a long time since the online casino regulation talks have been brought to the table in France, but the Pandora box have been reopened lately with the urge need for French Government to maximise state income. In the chaos of the recent proposed bill lies opportunities that the industry must seize.

History of the French Casino Market

Initially, a measure to enhance rural activities & to develop seaside resorts

Not going to far in the history, it’s Napoléon that created the very first gambling control institution in order to limit the development of the gambling habits in the population. Since then, few regulations have been introduced:

- in 1920 : Casinos can only be established near spa and tourist resorts, as well as seaside locations. However, exemptions may be granted by the Ministry of the Interior to set up a casino in areas not meeting these criteria, if it could help boost the local economy.

- In 1969 & 1987: Blackjack, Roulette and slots machines are legalized

- in 1988 : Gambling venues are legalized and not limited to the previous geographical criterias; and can now be opened in city that have more than 500.000 inhabitants

Moving forward to the Online World

Early 2000’s, France was a grey market for Online Casinos, with the first one under the name of its owner, Partouche. It’s in 2007 & in 2010 that the French Government regulated what we now call « iGaming », with the legalization of Sports betting but Online casinos have remained forbidden since then.

Forbidden but still growing

Recent studies shown that more than 500 websites are targeting french consumers, representing around 1.5 billions euros in Gross Gaming Revenues. Moreover, the same study (ran by ANJ) mention that 79% of the players of illegal online casinos could be risking addiction.

Transforming the risk into opportunities for landbased operators

In every country that legalized online casinos, doubts concerning the sustainability of the landbased gambling sector have been raised. Arguing that’s unfair competition for the companies that have high costs and limited accessibility for players. Les études montrent généralement une bonne cohabitation entre les opérateurs terrestres et les acteurs en ligne.

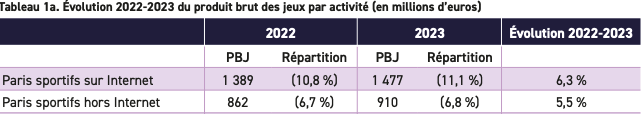

In France, the sports betting industry faced similar concerns, yet ANJ statistics show that physical sports betting remains stable (+5.5% in 2023).

Our goal is to merge both worlds, allowing industry experts to expand while minimizing risks to public health and the local economy. Land-based casinos already contribute significantly to local communities and the state, and digital expansion is a logical progression for the sector.

Opportunity to Open Up a Restricted Market

The French casino market is geographically limited, as most establishments are in tourist areas and benefit from seasonal visitation. Yet, as seen in physical retail trends, younger generations (Gen X, Y, Z) are less inclined to visit physical sites. Land-based casino visitation is already declining (source), and no legal alternatives are currently offered.

Phygital Strategy to Revitalize the French Casino Industry

Legalizing online casinos will bring challenges for both new entrants and established operators. We believe existing land-based casinos have a wealth of advantages to leverage:

- Market knowledge: They understand which games resonate with their audience.

- Experience factor: A casino visit is an entertainment outing, much like visiting a theme park. Extending the relationship through a mobile presence is a powerful differentiator.

- Behavioral insights: Casinos can monitor player behaviors through data, enabling proactive measures against addiction.

Land-based casinos have the chance to broaden their reach beyond geographic limitations. Opening a digital channel offers a way to reach new customers. U.S. studies (EKG) show that online casinos do not cannibalize land-based revenue but can actually boost it (source).%80%9D)

Digital Compliance and Security as Safeguards

While fraud exists in physical retail betting, digital solutions can provide better compliance through KYC onboarding, serving as a barrier to entry for younger or at-risk audiences and limiting for AML and terrorism financing.

Preparing for Digital Transition: Opportunities and Risk Analyses

Various stakeholders must weigh the risks and impacts of online casino legalization carefully. The potential effects of this new market on public health and economics must be considered seriously.

For land-based operators, the customer service experience remains paramount. Digital services cannot fully replace human interaction, but they can enhance it

Among all the projects to undertake, the initial study phase must be prioritized. Examples within the gambling industry show that online and offline operators can generally coexist well, although much depends on the regulatory framework. It is in the interest of all stakeholders—including government bodies, addiction prevention associations, operators, and marketers—to actively engage in these studies to avoid missing out on emerging opportunities.

While the legalization of online casinos raises concerns for many stakeholders, it doesn’t necessarily entail a risk of deviant behaviors. On one hand, digital platforms allow for more restrictive measures than individuals, and on the other, the percentage of individuals receiving treatment for gambling addiction, cyber addiction, or mild eating disorders accounts for only 1.1% of the audiences at addiction treatment centers (CSAPA), showing a controlled increase even in a closed market.

We view these impacts as an externality of this new market’s entry.

Impact on IT Systems: Setting up an online casino solution calls for a critical review of the technological strategy, typically between ‘Make or Buy’ options. This analysis must be as thorough as possible, as it will directly affect user experience, marketing strategies, and the overall success of the project.

While it is unlikely that a land-based casino would choose to produce its own games, selecting the right provider is essential, given the popularity of certain games (like Aviator) in other markets.

Data Hosting: Data security is paramount, given the sensitive personal and financial information involved. Choosing a reliable partner is essential.

Compliance: Online, compliance, technology, marketing, and user experience are interconnected. Selecting the right KYC provider is crucial to facilitate player onboarding.

Impact on Organizational Setup: Structuring for this new line of business brings operational challenges.

Importance of Customer Service: Digital offerings cannot fully replace human interaction, and businesses must maintain contact through a dedicated service.

Expansion of Team Roles: Legal teams, for example, will now need to address digital matters, such as GDPR compliance and monitoring banned players.

Workforce Reallocation: Given declining visits in land-based casinos, reallocating staff to other locations or online markets is worth considering.

Impact on Marketing: The Barrière Group has already leveraged its casinos as event spaces linked to gaming and eSports. However, targeting a ‘digital-first’ audience requires a revamp of both acquisition and retention strategies. As we’ve seen in other sectors, like banking (and the pitfalls of bonus abuse link), an optimal user experience, with the right products and services, is key to retaining a customer base. Marketing costs are also likely to rise, especially through affiliate channels (which could be offset by using a revenue share strategy to limit CPA cash flow)

Orchestrating this transition effectively requires dedicated resources and support

Allocating internal teams and assigning them to this launch is critical to ensure that no aspect is overlooked. However, even more than relying on the company’s internal resources, engaging external experts is essential for a successful digital transition, and the right support is a key factor in building a strong phygital strategy that leaves no aspect of the business overlooked. Bringing in experts who have encountered similar challenges in other sectors, like retail or banking, can provide valuable insights and fresh perspectives on the digitalization process.

The Gambling Cockpit is here to support you through strategic planning, scoping, and project scheduling as we anticipate the upcoming legalization of online casinos.

With 8 years of experience across multiple sectors, including iGaming, Pierric has supported executives in their growth strategies, cost optimization, market entry, and project management with rigor, efficiency, and innovation.

Pierric Blanchet

Founder @ TGC