Our post-merger integration consultants don’t just manage the process; they partner with you to develop a customized Integration Thesis—a strategic roadmap aligning the integration with your overall objectives. We then focus the integration on the key decisions that drive maximum deal value: defining the optimal operating model for growth, strategically combining go-to-market functions, and proactively addressing cultural differences to ensure a smooth and successful transition..

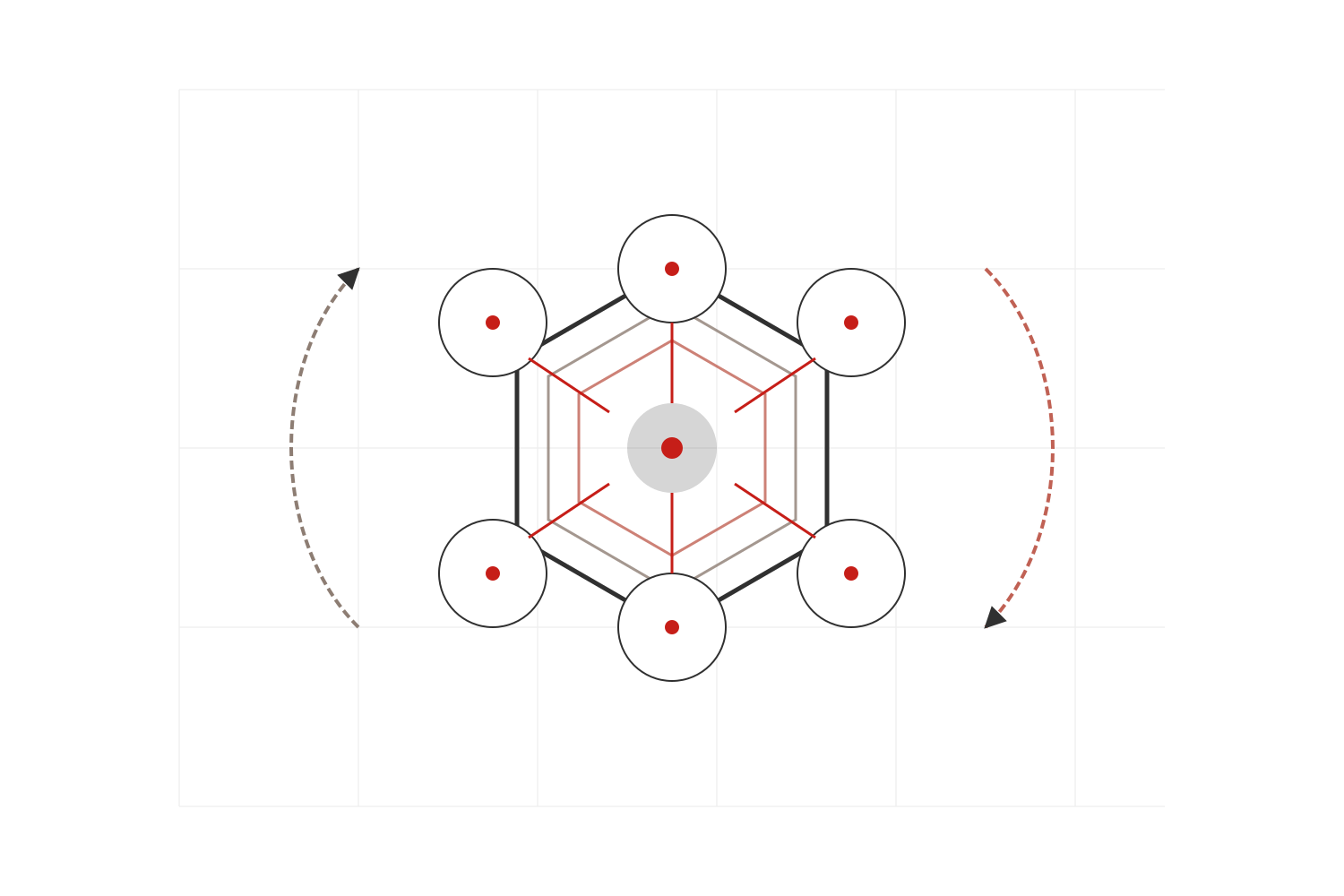

The Gambling Cockpit’s PMI tailored approach

Strategy

- Designing the perfect Post Merger Integration strategy is key to ensure your acquisitions deliver the full potential expected.

- We build & deliver different scenarios in order to bring results as fast as possible, not relying on a big-bang tactic.

- We developped the « Perfect Cost To Run » framework allowing us to ensure the PMI brings maximum financial results and incremental revenues, without increasing costs.

Program Management

- Either we supported you in the M&A process or not, The Gambling Cockpit manages the full PMI process, from auditing key scenarios or key risks.

- We’re highly experienced in running critical Post Merger Integration projects, in many industries (iGaming, Retail, Start-ups, Corporates)

- TGC doesn’t copy and paste what worked with its previous clients; we adapt any projects to your specific context.

Our convictions on Post-Merger Integration for the Gambling Industry

We’re convinced that acquiring is the easy part, even though it remains challenging. But having a stand-alone product doesn’t always contribute properly to your business strategy.

Merging is often a great solution, but comes with its own difficulties, such as :

- Cultural fit

- Technologic matters

- Redundant assets and resources.

TGC provides comprehensive Post-Merger Integration support throughout the entire process. We partner with clients to develop the ideal integration strategy, perform detailed due diligence, and oversee every facet of execution to guarantee a seamless and successful transition.

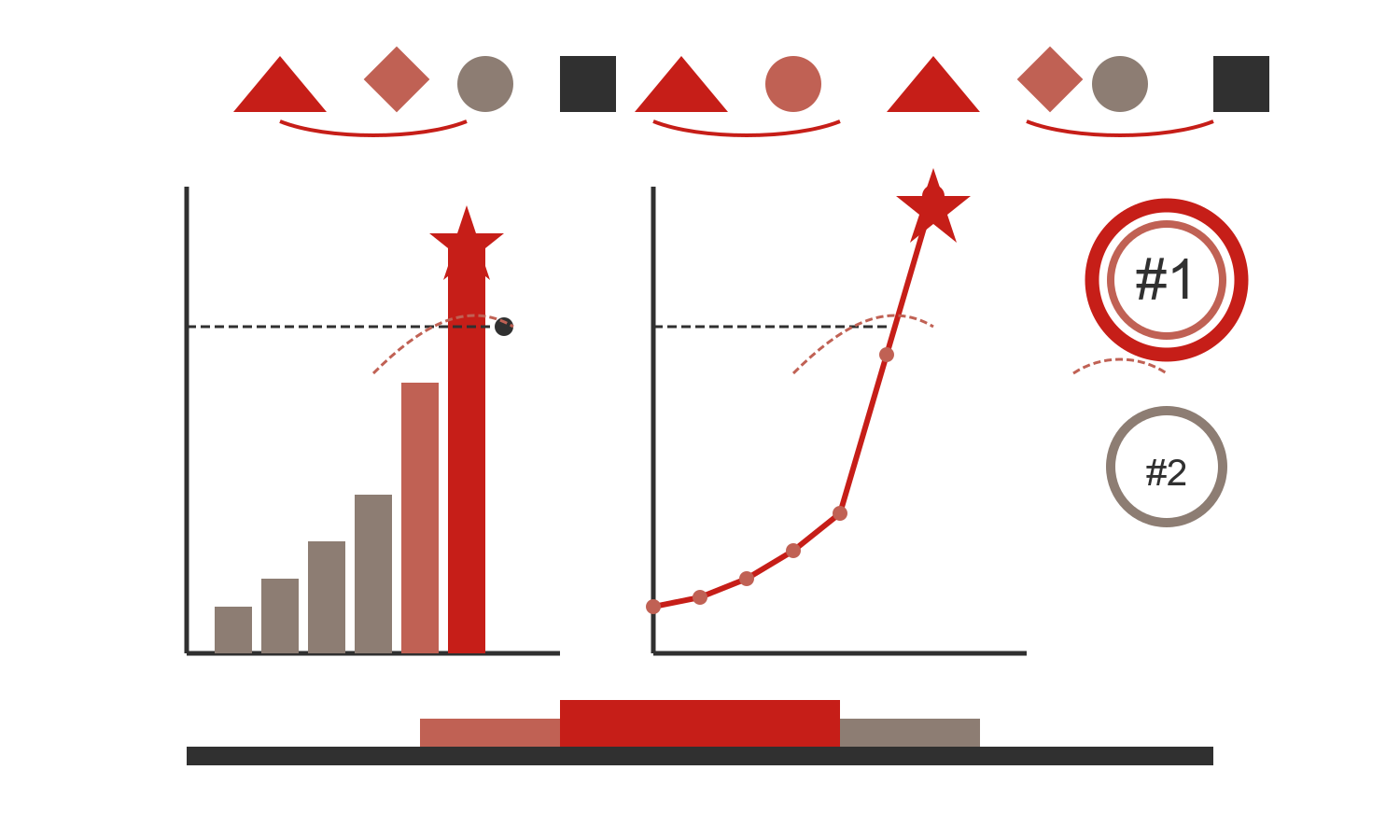

Our track record

We have supported iGaming leaders in their M&A ambitions

Acquisitions managed

PMI Projects delivered

Post merger Process

We’ve worked with

The kind of projects we ran…

Our Content on Merger and Acquisitions & PMI

Avoiding the Early Negotiation Trap: What iGaming Executives Should First Ask an M&A Advisor

Table des matièresFrom contract to Value CreationWhy contractual term questions are insufficient in the first contactThe illusion of the Success Fee’s simplicityInfrastructure assessment is a risk, not a requirementThe Strategic Analysis Framework: the questions that create valueQuestion 1: Strategic Fit Diagnosis (The Deep Alignment)Question 2: The Valuation Deep Dive (Beyond EBITDA)Question 3: Identifying Hidden Risks…

EBITDA vs Free Cash Flow : key differences and their role in M&A

Table des matièresUnderstanding EBITDA: A Proxy for ProfitabilityLimitations of EBITDAFree Cash Flow: The True Measure of Cash GenerationWhy Free Cash Flow MattersLimitations of Free Cash FlowComparing Valuation Methods: DCF and BeyondChallenges of DCFWhen to Use DCFChallenges of EBITDA MultiplesWhen to Use EBITDA MultiplesDCF vs. EBITDA Multiples: Which is Better?Strategic Takeaways from The Gambling CockpitConclusion: Follow…

Structuring the first M&A Team in a fast growing business

Table des matièresDefining a great M&A strategy Assembling a Core-TeamLeverage industry knowledgeBuilding a strong networkTGC’s recommendationsFAQ In our rapidly evolving industry, numerous enterprises have turned to mergers and acquisitions (M&A) as a strategic lever to accelerate their growth objectives, achieving varying degrees of success. Many of these corporations were initially founded by visionary entrepreneurs who…

Preparing the exit : a quick guide for iGaming entrepreneurs

Table des matièresWhy preparation is the cornerstone of sell-side M&A success ?1. Build dedicated and accurate financial statements.2. Anticipate currency and market risks3. Document core processes and tools4. Create a comprehensive architecture scheme5. Identify and engage key stakeholders6. Prepare IP documentations7. Building the teaserPierric BlanchetFAQ Selling a business is an opportunity that lot of entrepreneurs…

M&A Transactions in 2024, the year of records ?

Table des matièresThe biggest transactions come from Operators and suppliersEven after GCU 2024, affiliates are still acquiring.2025 is consolidation year – but who will takes advantage of it ?Pierric BlanchetFAQ 2024 have been a really intense year in terms of M&A for our industry, with lots of transactions amongst the full value chain. Still, the…

Valuating your iGaming : key criterias for successful M&A.

Table des matièresFacing iGaming entrepreneurs incomprehensionsAssets have metrics before having a price.Different ways to valuate your businessComparable company analysis (CCA)Precedent transactions analysisDiscounted Cash-flow (DCF)Pierric BlanchetFAQ Working with multiples iGaming businesses in their M&A strategy, The Gambling Cockpit have understood that valuating a business or assets is sometimes a bit tricky. When it is about valuation,…