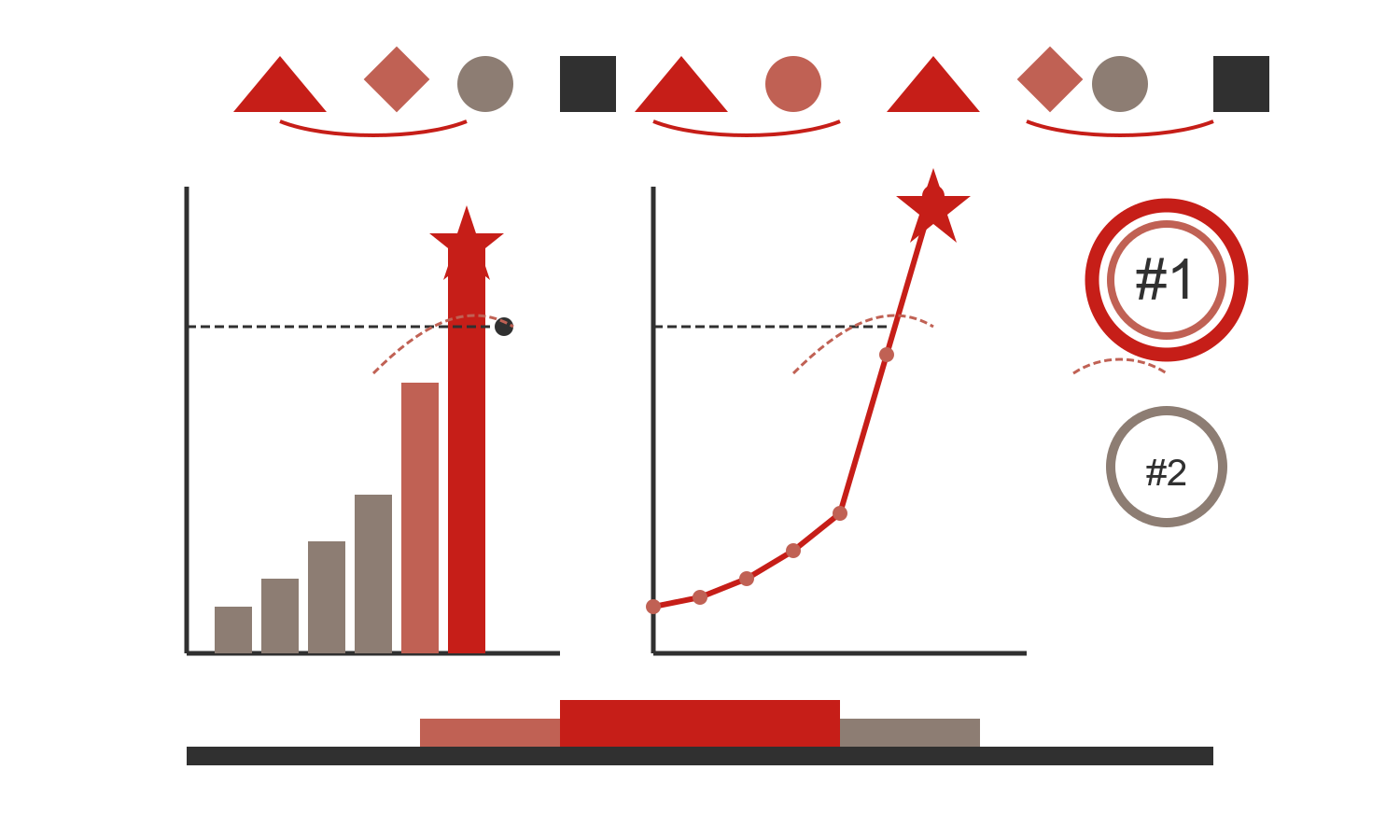

The Gambling Cockpit intervenes throughout the entire value chain of your M&A strategy to industrialize the approach while delivering results within short timeframes, ensuring that no opportunities are missed; at the best valuation.

The Gambling Cockpit’s M&A value proposition

Strategy

- A thorough understanding of our clients’ ambitions is paramount. This enables us to create a seamless experience and focus on achieving impactful outcomes..

- TGC identifies acquisition targets per assets or geographical zone, that either bring values to the core-business or come diversifying revenue sources.

- We also support our client in divesting strategies, making sure the business remains healthy.

- We support our client ambitions by designing strategies (asset types, geos, budgets, type of deals)

- TGC have a 2000+ assets list that could match any of your ambition in

Execution

- We start producing results by sorting leads, contacting our network in banks and reaching potential sellers.

- Precise iGaming Valuations: In the iGaming industry, accurate valuation is paramount for successful M&A. We deliver precisely tailored assessments that account for the unique complexities of this market.

- We put in place right tools and processes to industrialise M&A, still remaining opportunistic.

- We support our client from the strategy until the closing, from the due dilligence, to the Post Merger Integration.

- To secure our client’s interest, we’re structuring the deals (financials, tax, legal…)

Our convictions on Mergers and Acquisitions for iGaming

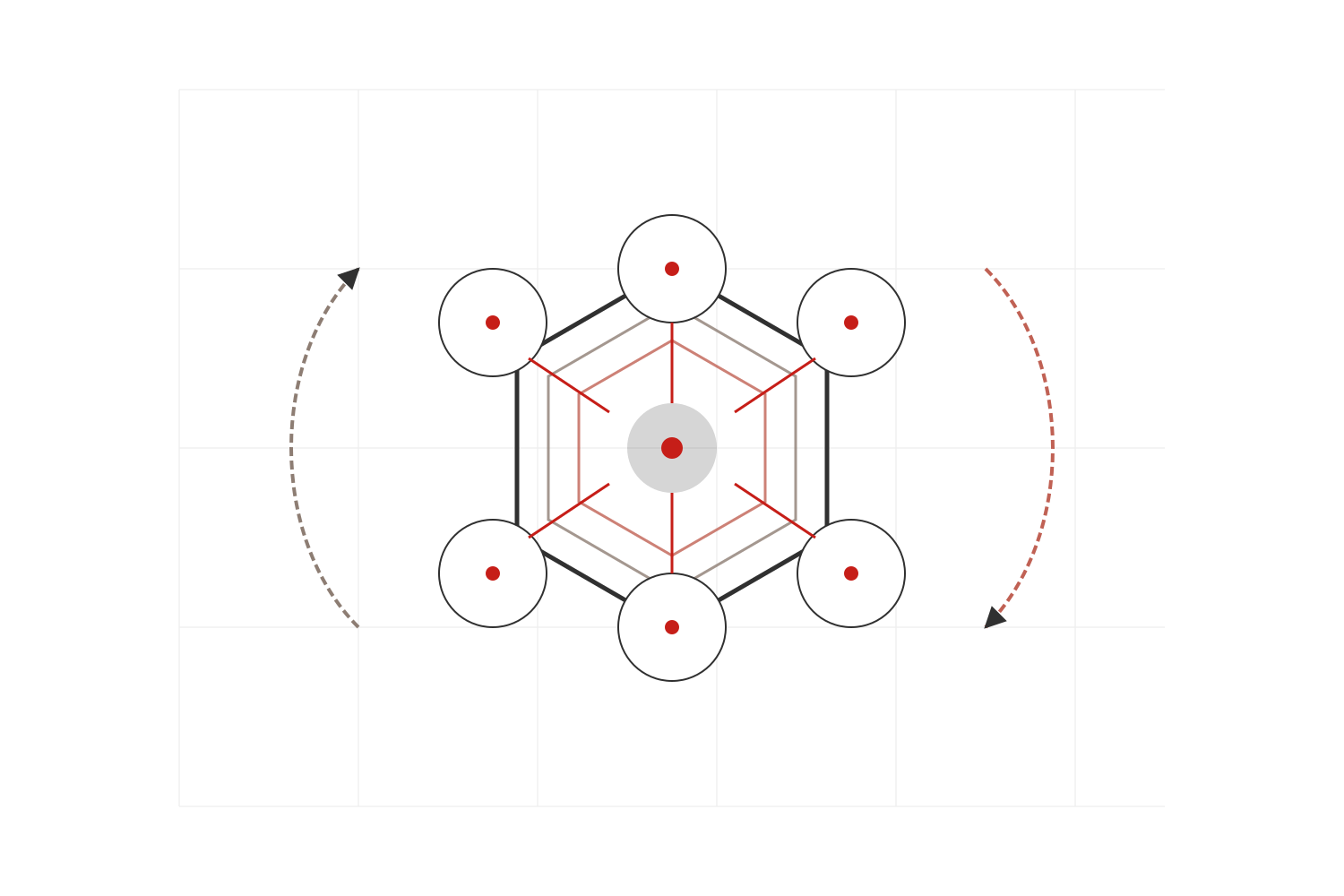

The Acquisition is the easy part, even though finding and closing great opportunities is still challenging. But when paying a large amount of money to enhance the core-business strength, no one can take the risk of failing Integration, that will add even more to the loss.

TGC’s Post Merger Integration expertise encompasses the full project lifecycle. We work closely with clients to define the optimal integration strategy, conduct thorough assessments, and manage all aspects of project delivery, ensuring a smooth and successful transition.

Our track record

We have supported iGaming leaders in their M&A ambitions

Acquisitions managed

Transactions

Post merger Process

We’ve worked with

The kind of projects we ran…

Our Point of View on M&A in iGaming

Avoiding the Early Negotiation Trap: What iGaming Executives Should First Ask an M&A Advisor

Table des matièresFrom contract to Value CreationWhy contractual term questions are insufficient in the first contactThe illusion of the Success Fee’s simplicityInfrastructure assessment is a risk, not a requirementThe Strategic Analysis Framework: the questions that create valueQuestion 1: Strategic Fit Diagnosis (The Deep Alignment)Question 2: The Valuation Deep Dive (Beyond EBITDA)Question 3: Identifying Hidden Risks…

EBITDA vs Free Cash Flow : key differences and their role in M&A

Table des matièresUnderstanding EBITDA: A Proxy for ProfitabilityLimitations of EBITDAFree Cash Flow: The True Measure of Cash GenerationWhy Free Cash Flow MattersLimitations of Free Cash FlowComparing Valuation Methods: DCF and BeyondChallenges of DCFWhen to Use DCFChallenges of EBITDA MultiplesWhen to Use EBITDA MultiplesDCF vs. EBITDA Multiples: Which is Better?Strategic Takeaways from The Gambling CockpitConclusion: Follow…

Structuring the first M&A Team in a fast growing business

Table des matièresDefining a great M&A strategy Assembling a Core-TeamLeverage industry knowledgeBuilding a strong networkTGC’s recommendationsFAQ In our rapidly evolving industry, numerous enterprises have turned to mergers and acquisitions (M&A) as a strategic lever to accelerate their growth objectives, achieving varying degrees of success. Many of these corporations were initially founded by visionary entrepreneurs who…

Preparing the exit : a quick guide for iGaming entrepreneurs

Table des matièresWhy preparation is the cornerstone of sell-side M&A success ?1. Build dedicated and accurate financial statements.2. Anticipate currency and market risks3. Document core processes and tools4. Create a comprehensive architecture scheme5. Identify and engage key stakeholders6. Prepare IP documentations7. Building the teaserPierric BlanchetFAQ Selling a business is an opportunity that lot of entrepreneurs…

M&A Transactions in 2024, the year of records ?

Table des matièresThe biggest transactions come from Operators and suppliersEven after GCU 2024, affiliates are still acquiring.2025 is consolidation year – but who will takes advantage of it ?Pierric BlanchetFAQ 2024 have been a really intense year in terms of M&A for our industry, with lots of transactions amongst the full value chain. Still, the…

Valuating your iGaming : key criterias for successful M&A.

Table des matièresFacing iGaming entrepreneurs incomprehensionsAssets have metrics before having a price.Different ways to valuate your businessComparable company analysis (CCA)Precedent transactions analysisDiscounted Cash-flow (DCF)Pierric BlanchetFAQ Working with multiples iGaming businesses in their M&A strategy, The Gambling Cockpit have understood that valuating a business or assets is sometimes a bit tricky. When it is about valuation,…